We’ve written about rising interest rates in our recent article, The State of Private Lending 2022. You’ve seen the headlines as inflation continues and mortgage rates rise. Even so, there are still plenty of opportunities in the fix-and-flip market.

For example, as home building declines, more builders are eager to work on your projects. Plus, there are still lenders seeking opportunities to support worthy projects. And, as we say in our article, the housing shortage isn’t going away.

This article provides insight into typical interest rates for fix-and-flip loans. It also discusses the factors you’ll need to meet to qualify for those loans.

Fix-and-Flip — What Is It?

A fix-and-flip project is when the borrower purchases a distressed or run-down property. They then invest time and effort fixing it up before reselling it. The project usually takes less than 12 months and seldom more than 18 months. That quick turn requires skill, drive, and a solid financing option to make everything work.

Fix-and-Flip — Financing Options

Banks typically will not consider providing a loan for a home in poor condition. Since that’s the starting point for the optimum fix-and-flip project, you’ll need to find another source of financing. You’ll also need to find the right loan term to match your project, and that has the flexibility to be extended if you run into delays.

Private investor hard money loans are perfect for financing the purchase and the cost of fixing the house. These lenders can take on more risk than traditional lenders in exchange for a higher interest rate and fees. They will also often underwrite loans for borrowers with no other financing options or low credit scores.

Private hard money lenders are primarily concerned with the property used as collateral and the amount of equity the borrower holds. They will also closely examine the borrower’s ability to pay the interest on the loan. That evaluation will come from the borrower’s record on previous projects and their current business plans.

Fix and Flip Loans — Rates and Fees

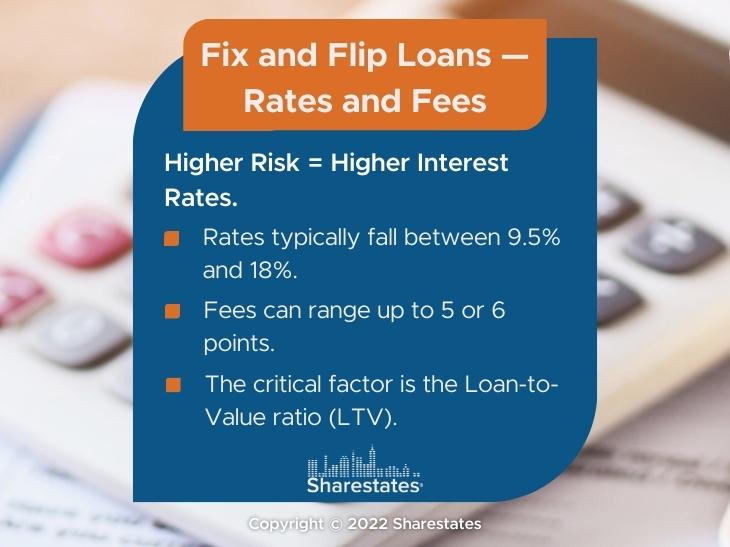

The higher risk associated with fix-and-flip loans results in higher interest rates. That higher rate attracts investors and, as a result, supports borrowers with their real estate projects.

Rates typically fall between 9.5% and 18%. Fees can range up to 5 or 6 points. Within that broad range, many factors will influence the rates and fees and the loan’s approval. You can find our current rates at Sharestates Bridge Loans.

The critical factor for fix-and-flip loans is the Loan-to-Value ratio (LTV). This is the ratio of the loan amount divided by the property’s appraised value. The LTV is usually lower than 80% of the property’s appraised value for a hard money loan. That means the borrower needs to provide a good-sized down payment to meet the property’s total purchase price. Note, too, that the lower the LTV, the lower the loan’s interest rate.

The loan can also be based on the After-Repair-Value (ARV) rather than the property’s current appraised value. The ARV estimates the property’s value after the repairs are completed.

The ARV-based loan hinges on the expected real estate market conditions at the eventual time of sale. Plus, it also depends on the timely completion of repairs. All of which increase the lender’s risk and the interest rate. The advantage is that it can provide the total funding for a fix and flip real estate project.

Most fix-and-flip loans have a term of fewer than 12 months but can extend up to three years. There may also be a prepayment penalty when paying off the loan before the full term since this results in less interest for the lender.

Of course, fix-and-flip loan rates and fees are a part of the overall loan market, rising and falling as the market changes. So, as you explore loan options, be prepared to adjust to prevailing market rates.

Fix and Flip Loans — How to Qualify

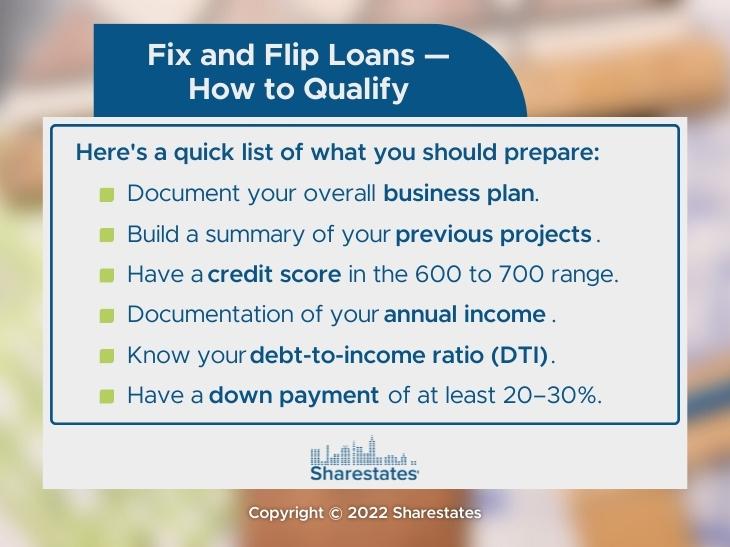

Qualifying for a fix-and-flip loan with a private hard money lender is much easier and quicker than obtaining a bank loan. Since the private lender is loaning the money to you, they will closely examine your credit, fix-and-flip experience, and business plans. Here’s a quick list of what you should prepare.

- Business Plan. Document your overall plans with close attention to the financial aspects.

- Previous Projects. Build a summary of your previous projects to demonstrate to a lender that you have a successful fix-and-flip experience.

- Credit Score. Lenders typically require a minimum credit score in the 600 to 700 range.

- Income. You’ll need to provide documentation of your annual income and that it exceeds your current debt.

- Debt-to-Income Ratio (DTI). This ratio is all your monthly debt payments compared to your gross monthly income. This will indicate your ability to repay the loan.

- Down Payment. The amount of the required down payment depends on the lender. It is typically at least 20% and can be as high as 30%.

All that will be the starting point for exploring your fix-and-flip loan options, rates, and fees.

For further background, see our article Guide to Private Real Estate Loans.

We hope this brief review has helped provide insight into fix-and-flip loan rates. Click here to learn more about funding your project through Sharestates.