Statistics and Trends

At Sharestates we believe in full transparency. We’re already an industry leader in many respects – now, we want to make data and information transparency one of those fields. Here’s how our company stacks up – if you’d like to see additional statistics that aren’t listed here, please don’t hesitate to contact us and give us your feedback!

Loans (Submitted, Closed, Total Volume)

Total Loan App Submissions

27610

Number of Loans Closed

4206

Total Volume of Loans Closed

$3.73 Billion

Cumulative Investor Return (Annualized)

$1 Billion+

Average Gross Annualized Returns

Year | Bridge Loans | Term Loans |

|---|---|---|

2015 | 12.27% | – |

2016 | 11.09% | – |

2017 | 10.98% | – |

2018 | 10.55% | 6.62% |

2019 | 10.49% | 6.21% |

2020 | 11.06% | 5.98% |

2021 | 10.34% | 5.02% |

2022 | 10.84% | 5.93% |

2023 | 12.48% | 8.4% |

2023 (Q1) | 12.88% | 8.25% |

2023 (Q2) | 12.48% | 8.29% |

2023 (Q3) | 12.80% | 8.32% |

2023 (Q4) | 11.72% | 8.74% |

Average Valuation Metrics

Average Day 1 LTV

67.48%

Average ARV

56.75%

Average LTC

82.43%

Average Loan Size

$886,372

Loan Defaults & Investor Losses

# Loans 60+ Days Past Due

87

Past Due Rate*

2.06%

# Loans in Foreclosure

90

Foreclosure Rate*

2.13%

# of REO Properties

100

REO Rate*

2.37%

Total Principal Loss to Date**

TBA

*Past Due/Foreclosure/REO Rate is calculated by dividing the current number of Loans in Past Due/Foreclosure/REO by the Number of Loans Closed.

**Measured as the actual principal loss for defaulted loans that have been fully resolved.

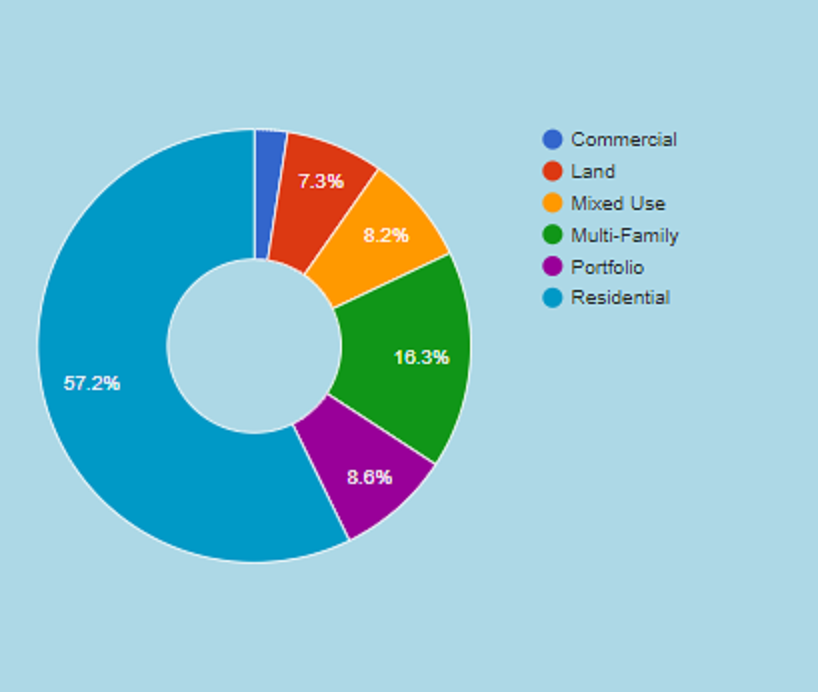

Asset Classes

(Percentage by Loan Volume)

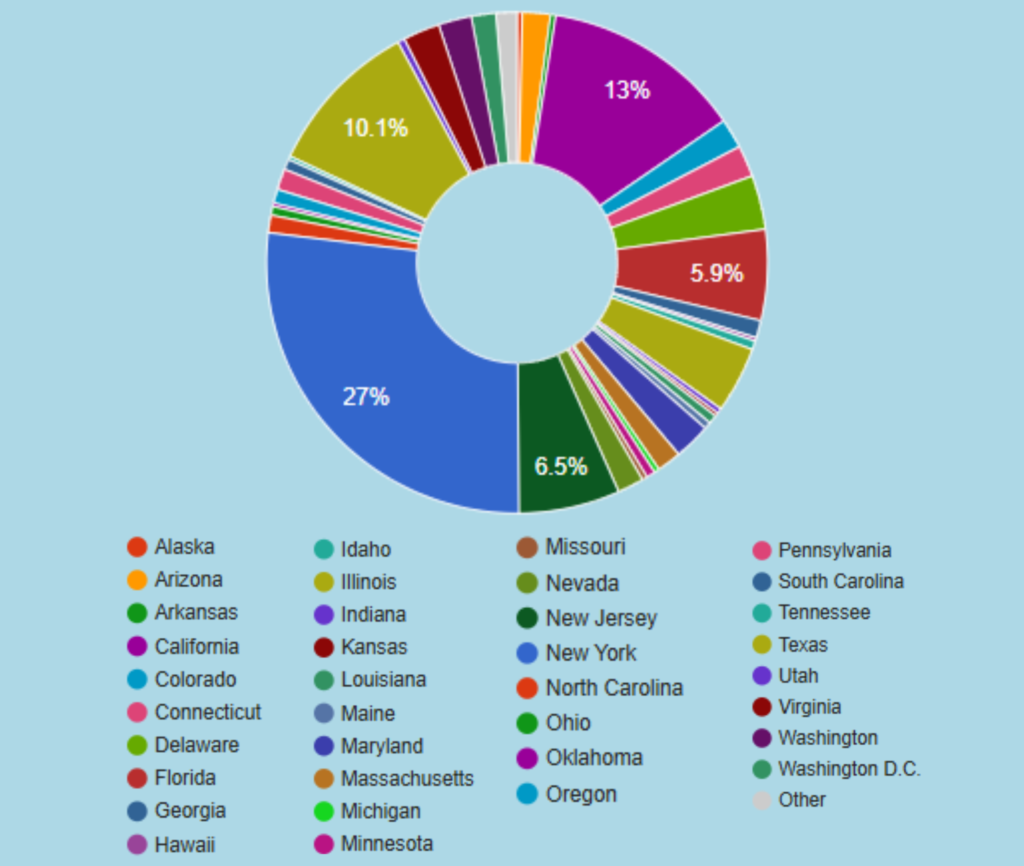

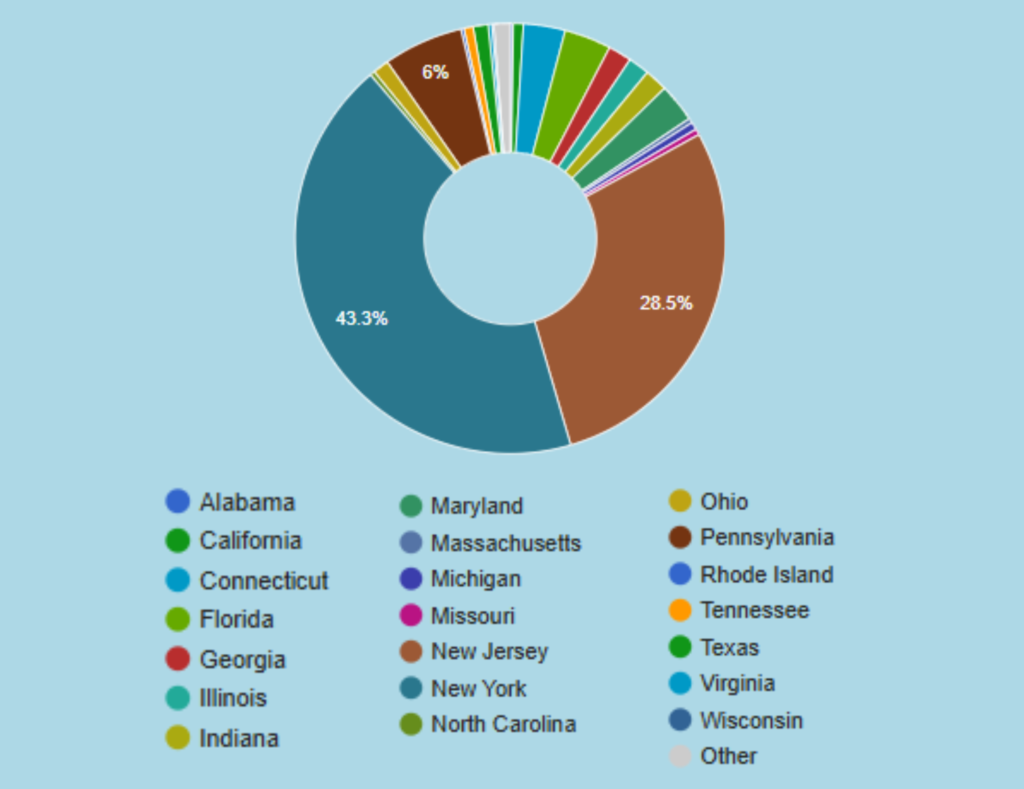

Number of states we’ve lent in

(39)

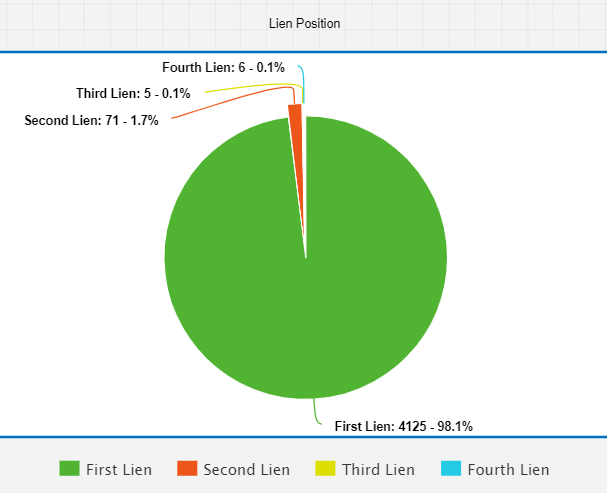

Lien Position

(Percentage by Loan Volume)

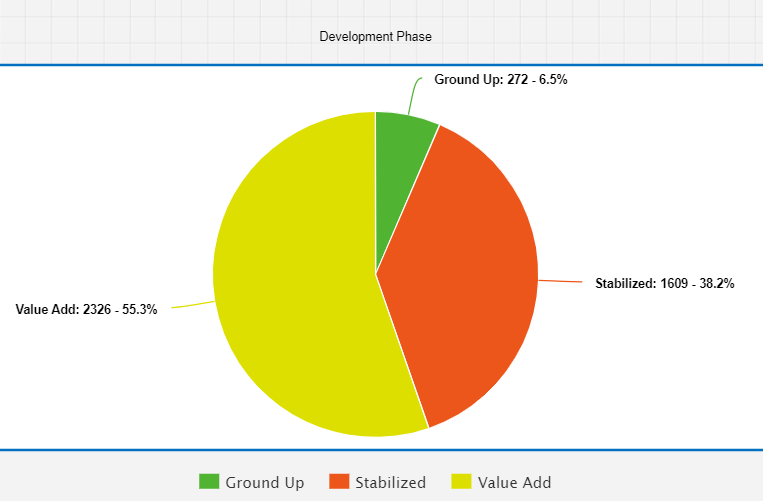

Development Phase Chart

(Stabilized, Rehab and Ground Up Loans)

Investor's states

(44)

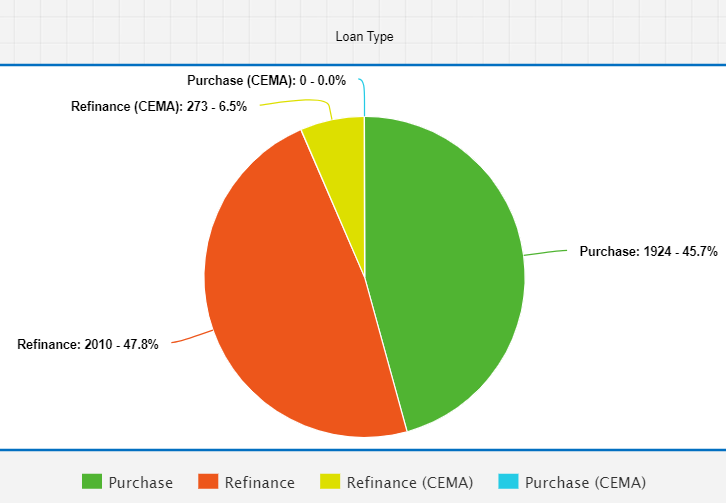

Loan Type

(Percentage by Loan Volume)

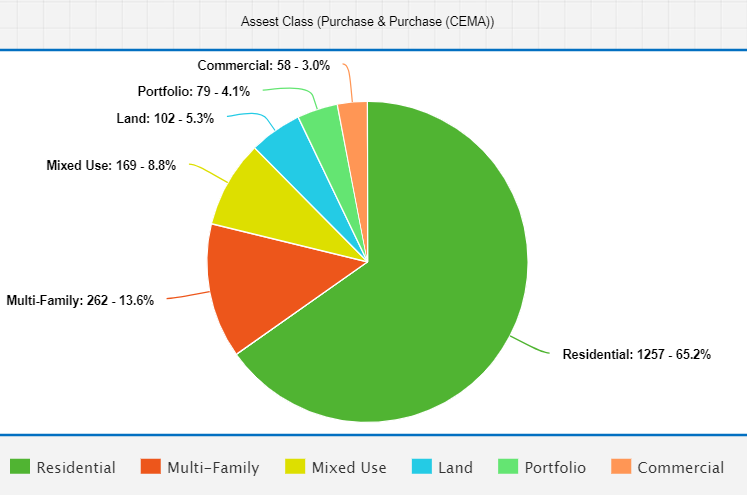

Asset Classes (Purchase)

(Percentage by Loan Volume)

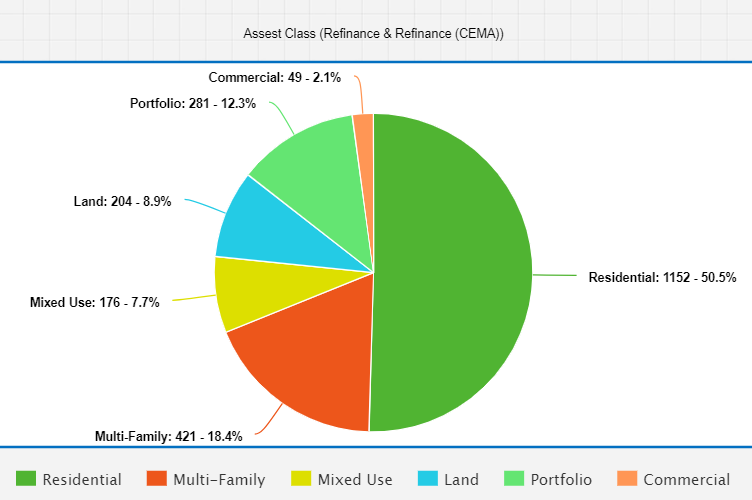

Asset Classes (Refinance)

(Percentage by Loan Volume)

Total Principal returned (Loans Paid Off)

$2,28 Billion

Loans Paid Off

2684

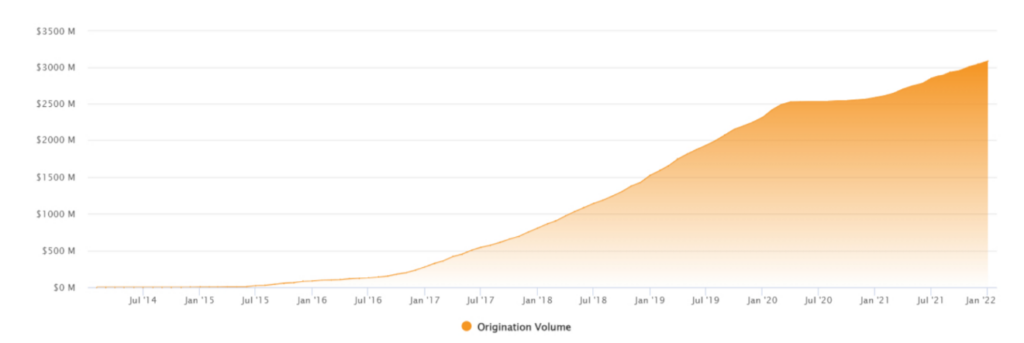

Origination Volume Growth