There’s a lot of news behind the sudden surge in the single-family rental market, but it’s all driven by two factors that ought not to be news:

1. The economy is basically good.

2. People are basically good.

Of course, both those statements are controversial and we’ll discuss them one at a time but, for now, let’s take a look at where SFRs have been and where they are now.

The New Single-family Normal — Like the Old One, but Better

In 2005, SFRs accounted for 51% of the total rental housing stock in the U.S., according to the National Rental Home Council. In a decade, that rose to 57%. More recent data are hard to find, but we doubt it’s going down.

GlobeSt.com reports that over the course of the pandemic, single-family construction specifically for the rental market expanded by two-thirds.

“Builders are continuing to grow the construction pipeline in 2021,” GlobeSt.com’s Kelsi Maree Bourland writes, noting that Lennar Corp. is placing a $4 billion bet on the market. “The demand also caught the attention of institutional capital. JLL bought into Roofstock, an online rental housing platform; SFR firm Avanta Residential invested $500 million into the market, and the Wisconsin Investment Board approved a $150 million commitment to the Hudson Single-Family Rental Fund. This year, Progressive Residential has securitized four of the five largest SFR deals, investing a total of $2.8 billion in the space compared to $1.3 billion last year.”

The people closest to the market have observed that sharp uptick firsthand.

“The single-family home rental market is absolutely on fire,” Jeff Pintar, CEO of California-based Pintar Investment Co., told Phil Britt at DS News. “In all aspects of it, it’s continued to get stronger and stronger and has continued to evolve. The operational efficiencies of this business are actually far better than multifamily or other asset classes.”

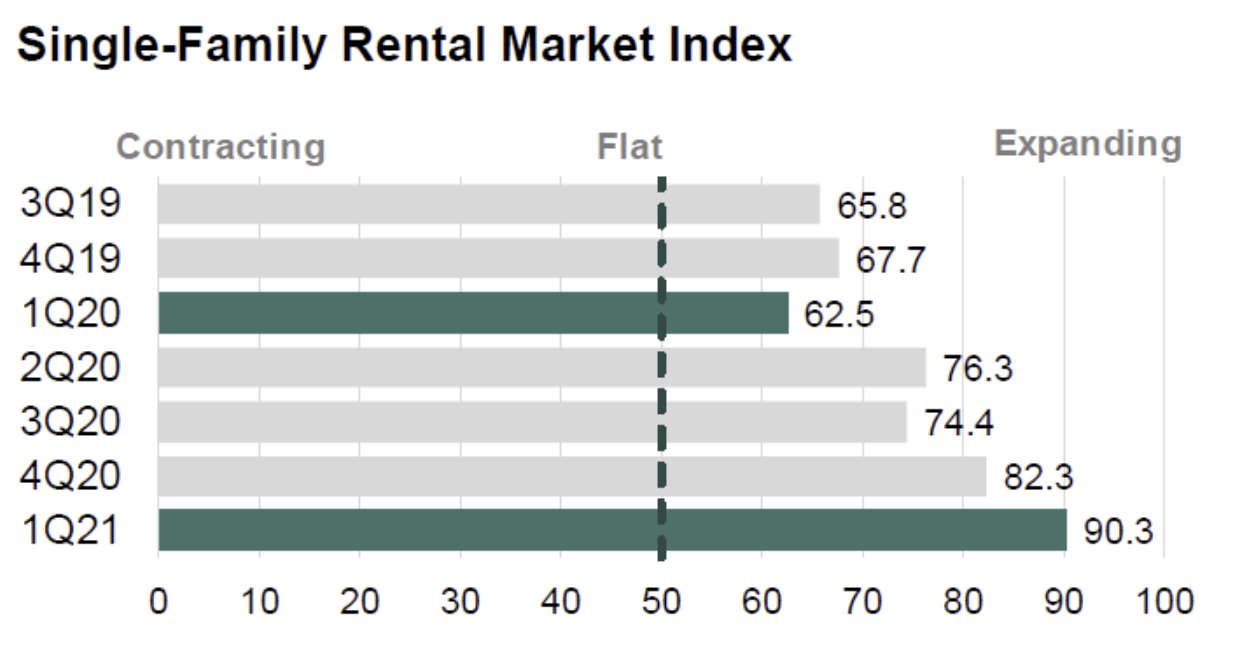

More empirically, a joint National Rental Home Council/John Burns Real Estate Consulting study found that “the SFR industry is extremely bullish on current leasing activity (94 index reading in 1Q21 vs. 85 in 4Q20) and even more optimistic on expected leasing activity for the next six months (96 index reading in 1Q21 vs. 91 in 4Q20”” on a 0-to-100 scale where 50 is considered normal. “For the first time in our survey, every operator expects continued strong leasing activity.”

A lot of this can be seen as a rebound from the low points of the pandemic shutdown. Months of pent-up demand were only one of them.

“In March of 2020, we were growing quickly, hiring, and growing our platform significantly,” Property Loan Exchange CEO Damon Riehl told Britt. “In late March, essentially all our sources of product, the lenders that we partner with, halted their lending activities for a period of 60 to 90 days, with some even longer than that. It created an environment where we had clients with the demand, but we didn’t have product for them available. Then things started to improve in the fall.”

Several interrelated factors drove that turnaround. People were spending more time at home, first by necessity, then by choice. And with home becoming an office, a classroom, a hobby workshop, and an entertainment complex all in one, suddenly smallish units in multifamily buildings lost their luster compared to more spacious single-family options.

This surge in demand was immediately recognized by the market.

The propensity for a tenant to renew their lease has significantly gone up,” Mike Tamulevich, an executive at Detroit-based Marketplace Homes, told DS News. “Typically, we would average in the 60% range for the tenants that are going to renew. Now, we’re in the mid-to-high 70s, with another 10% going month to month.” According to Britt, this translates into rents that are appreciating a little more than 4% annually.

It’s the economy …

By traditional definition, Covid-19 didn’t cause a recession. The National Bureau of Economic Research, which is in charge of these things, actually had to change the definition to account for the elevator ride in March, April, and May of 2020. While conceding that American economic activity is still not yet up to pre-pandemic levels, it is expanding — and started that expansion almost immediately after the initial shutdown.

Until last year, a recession involved at least two quarters of economic contraction. The 2020 recession lasted only two months.

So while we’re not technically in a recession and things are looking up, we’re not out of the woods. And that’s why the Federal Reserve is keeping target interest rates low. While spikey sometimes, the bond markets have more or less cooperated.

And, while inflation has certainly become something to keep an eye on, it doesn’t look like we’re in for a bout of hyperinflation or even of particularly high inflation.

… and nobody’s calling anybody ‘stupid’

Throughout the pandemic, governments at all levels gave tenants all the breaks they could to delay paying their rent. These moratoria gave renters legal cover to stop making payments.

Tenants ended up paying it anyway. Nobody likes their landlord, so if you can get away with stiffing him, why not? It’s because people legitimately want to pay their bills. Maybe they’ll take whatever government money finds its way direct-deposited into their checking accounts, but most do their best to keep current.

“We’ve experienced less than a 2% delinquency rate for 2020 on our portfolio,” Pintar said. “People do whatever they can to protect their housing. By and large, people do the right thing. If they can pay their bills, they’re going to pay them.”

And because they paid on time, their landlords could pay their debts on time.

“In April, the delinquency rate of SFR loans had dropped … to 0.31%. This was also reflected in the special servicing rate, which peaked at 0.66% for SFR properties but registered at 0.41% for April 2021,” according to Maximillian Nelson at analytics firm Trepp. “For comparison’s sake, the delinquency and special servicing rates for the overall CMBS universe peaked at 10.32% and 10.48%, respectively, in June and October of last year.”

Some of this is because of who the landlord is: a fellow human being. But that might be changing.

“Individuals still dominate as single-family rental landlords, but companies and corporations are taking a bigger share of the pie,” Rani Molla writes for Recode. “In 2018, the last available year for this data from the US census, companies and partnerships made up about 16 percent of single-family rental ownership while real estate corporations and real estate investment trusts controlled a growing 2.3 percent. Now about 20 percent of all home-buying activity is from investors.”

Molla notes that SFRl equities, like those for Invitation Homes and American Homes 4 Rent, are at all-time highs.

Potential Pitfalls Within the Single-family Market

Still, no business environment is ever perfect, and that goes for SFRs. There are always risks on the horizon.

The one that’s grabbing headlines today is the delta variant of covid-19. Frequent flyers have joked for decades that Delta is an acronym for “Don’t Expect Luggage To Arrive”. So who knows? Maybe virologists have a dark enough sense of humor to suggest it stands for “Don’t Expect Lethality To Alleviate”. We could be in for another mini-recession if we have to lock down again due to the delta strain.

Another macroeconomic concern is interest rates. They’re low now and probably will remain so through the end of next year or maybe the year after that. But they have to go up sooner or later, and that has a tendency to tamp down the entire Real Estate sector.

But the biggest factor is the bidding war engendered by the limited supply of SFR stock. It has developers, institutions, and single-family homebuyers crowding each other out.

Still, the biggest long-term concern for people investing in SFRs ought to be consumer behavior. While the data suggest that Millennials have a “preference” for renting a home as opposed to buying one, maybe you should ask some. They might tell you that they “prefer” to live in a rental rather than an owner-occupied property in much the same way their parents “prefer” to live in a split ranch rather than Buckingham Palace.