Purchasing a distressed property, fixing it, and then selling it for a quick profit can be very rewarding financially. But successfully flipping a house requires a well-thought-out plan and a source of short-term financing. This article provides insight into the types of loans and the costs to expect with a fix and flip house.

What Are the Types of Loans for Fixing and Flipping?

There is a wide range of loans available for fixing and flipping projects.

Loans for fix and flip projects are typically financed by private sources who specialize in matching investors with real estate projects. Banks are also an option. But will not usually finance properties in poor condition. Nor will they often take on the risk of renovations.

This list summarizes the options and provides insight into the pros and cons of each type.

- Cash-out Refinance. This loan uses the existing equity from your home to invest in the fix and flip property. This will result in a larger mortgage on your primary residence with attendant increased payments at current interest rates. The benefit is that interest payments may be tax deductible. The downside is that your home is on the line for the project. It can actually be foreclosed if you don’t keep up the payments. Plus, with today’s interest rates, you may wind up with higher interest and payments.

- Home Equity Loan. This type of loan is a second mortgage on a principal residence. You are, in essence, using your primary home as the collateral on your fix and flip property. Another disadvantage is that the loan amount available will depend on your home’s value. You can usually borrow up to 85% of the home’s value.

- Home Equity Line of Credit. This type of loan is a revolving line of credit secured by your home’s value. It’s like a home equity loan, but it’s more like a credit card, with payments changing based on the amount financed. Often the interest rate is variable and can change from month to month. The changing balance and interest rate can add variability to your monthly payments.

- 401(k) Loan. With this type of loan, you’re borrowing from your retirement funds. The approval process is usually straightforward, with any interest payable to your own account. The downside is that the IRS limits the amount you can borrow to $50,000. That limits your options for the fix and flix project. The other downsides are that you’re jeopardizing your retirement plans, and unpaid amounts can be designated as a plan distribution with attendant taxes and penalties.

- Personal Loan. This type of loan is provided by a lender based solely on your credit score and income. It is unsecured by any collateral. The benefit is that it is a quick and easy process. The disadvantage is that interest rates are high, and repayment terms vary from one lender to another.

- Crowdfunding. Real estate crowdfunding involves getting a large group of people to finance a project using a website or online tools to solicit funds. This funding source offers lower capital costs and shorter timelines for securing funds. Plus, there are several online systems readily available for project sponsors and investors.

- Hard Money Loan. With hard money loans, you can expect lower down payments, a quick qualification process, and flexible repayment terms. But you can also expect higher interest rates and shorter terms.

- Bridge Loan. Bridge loans are short-term financing, usually from six to 12 months and often 18 or 24 months. They are used to bridge one form of financing to another over the short term. That includes securing funding for the time needed to fix and then flip a real estate investment property. These loans offer quick qualifying and closing, terms ranging from weeks to months, and interest-only payments. Interest rates are higher than bank loans, and closing costs and fees are also higher.

- Rehab Loan. Rehab loans bundle both the purchase and renovation costs into a single loan. Rehab loans include FHA 203(K) construction loans and Fannie Mae HomeStyle renovation loans. These loans offer low down payments but require the borrower to live in the home along with several other arduous requirements.

What Does It Cost to Fix and Flip a House?

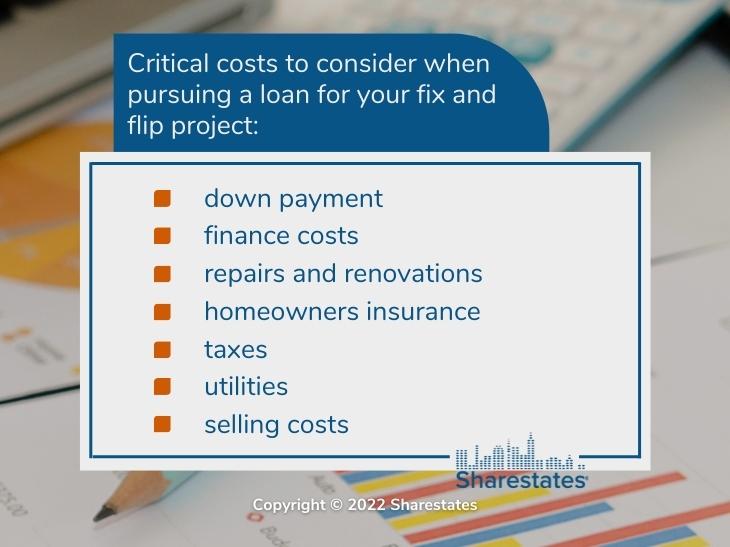

When pursuing a loan for your fix and flip project, it’s essential that you determine upfront all the money you’ll need and when you’ll need it. Here are the critical costs to consider.

- Down Payment. Down payments can range from 20% to 25% of the purchase price. That also depends on the type of loan you’re seeking.

- Finance Costs. During the loan term, which runs from the original purchase to the final sale, you’ll be paying interest on the loan. The amount will depend on the type of loan and the interest rate.

- Repairs and Renovations. This is the cost of materials and labor for all the fixes and renovations. It’s also wise to include a contingency amount to cover those unexpected challenges that can happen as you start on the repairs.

- Homeowners Insurance. While owning the house, you’ll need to maintain homeowner’s insurance to protect you and the lender’s investment.

- Utilities. You will need electricity to operate all those power tools during the renovation. It would help if you had lights, heat, air conditioning, and water. So you’ll need to pay the utility bill monthly during the project.

- Taxes. You’ll be expected to pay property taxes while you own the house and capital gains taxes on home sales. Depending on your income tax bracket, short-term capital gains taxes range from 10% to 37%.

- Selling Costs. That includes marketing the property, closing costs, and final sale.

What Are the Best Loan Options for a Fix and Flip Project?

Every fix and flip project is different, as are the investors and the resources they bring to the effort. As spelled out above, there are advantages and disadvantages to every type of loan. As you pull together your business plan in preparation for applying for a loan, consider all the options to find the loan that works best for your business goals.

That’s where Sharestates can help. We’ve provided a brief guide to private real estate loans. It includes details on what you need to do to secure a private loan. You can also review our article on the pros and cons of private real estate loans.

Click here to learn more about funding for your fix and flip business through Sharestates.