For the home buyer, rising home prices, mortgage rates, and somewhat cooling rental rates have significantly changed the decision-making process. According to the Wall Street Journal, the median monthly mortgage payment increased to 1.44 times the monthly asking rental payment at the end of the second quarter of 2022. Market data is one aspect to consider when deciding whether to fix and flip a property versus fixing and renting a property.

To put this in perspective, in the fourth quarter of 2020, the median mortgage payment and asking rent was just under $1,200. As of June 2022, mortgage payments rose 58% to $1,893, while rents have risen 10% to $1,314. This makes rents look far more attractive and could place a home purchase out of reach for many prospective home buyers. Of course, you’ll find that the rental rates in different regions of the country and even different neighborhoods will vary significantly.

This article digs into the pros and cons to further assist your fix and flip vs fix and rent decision-making.

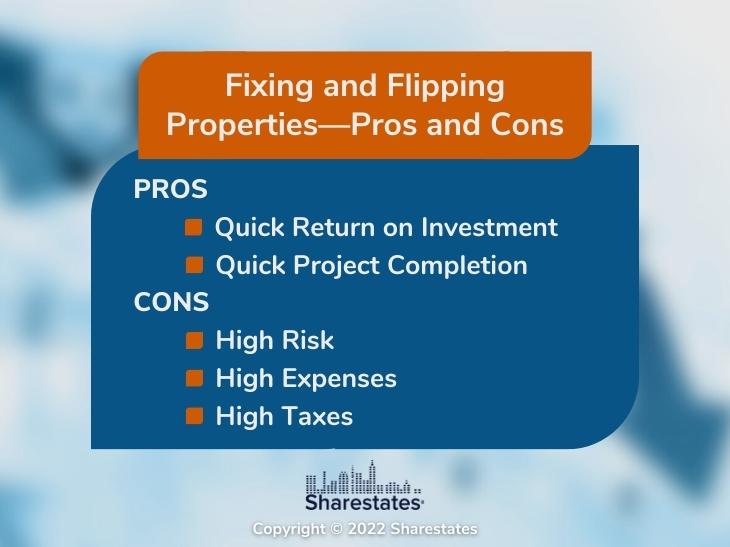

Fix and Flip Properties — Pros and Cons

Flipping homes is a short-term active investment that can quickly generate considerable money. The above numbers show that mortgage interest rates and home prices are also rising. Even so, there are two major pros of a fix and flip property.

- Quick Return on Investment. House flipping provides an excellent return on investment in a few months and is seldom more extended than a year. Buying, fixing, and selling a distressed property makes money on your labor and savvy ability to find the right property.

- Quick Project Completion. Along with a short timeframe, your project is completed quickly so you can move on to the next project. That further helps to reduce the risk associated with fixing and flipping.

Quick is a significant advantage, whether timely completion or investment return. There are also a few cons that come along with those advantages.

- High Risk. Real estate markets change quickly, exposing your investment to risk. For example, you could end up with a lower home value than you paid if the neighborhood declines or mortgage rates rise. That results in a limited number of buyers interested in your property. There are project risks of taking too much time or running over budget with repairs that weren’t discovered before the purchase.

- High Expenses. The expenses involved in flipping a house include financing, insurance, real estate commission, closing costs, repair work, and utilities. Your plan will need to consider all this before the purchase to ensure the project provides a reasonable rate of return.

- High Taxes. If the purchase, fix, and sale is completed within a year, the profits will be taxed as regular income, from 25% to as high as 40%. If it’s longer than a year, it will be a capital gains tax, which is lower at 15% to 20%.

For further insight, see our articles Top 10 Fix and Flip Markets and How to Find Wholesale, REO, and Short Sale Properties.

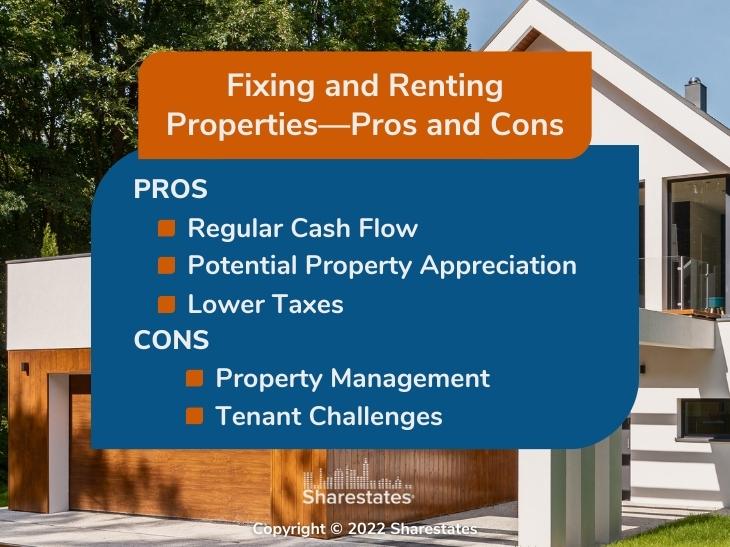

Fixing and Renting Properties — Pros and Cons

Rental properties are long-term passive investments that build cash flow. That income is offset somewhat by ongoing expenses. But that also lowers your income tax bill. The challenges are maintenance and making sure you have full occupancy. An empty rental property isn’t making any money.

- Regular Cash Flow. Rental properties provide an ongoing monthly income. That steady cash flow isn’t as lucrative as flipping, but it continues to provide income long after you’ve made the purchase.

- Potential Property Appreciation. The rental property’s value should increase over time based on inflation. In addition, market conditions can drive prices up where available homes are in short supply. That means the longer you hold the property, the higher its value.

- Lower Taxes. The tax rate on profits from rental income is 15% to 20%. That profit is based on deducting maintenance and other related expenses and the depreciation of the property.

Rental income, property appreciation, and lower taxes increase your wealth. Along with the pros, there are always some cons.

- Property Management. The fixing part of a rental typically requires repairs before renting, followed by ongoing regular maintenance. That maintenance can be alleviated somewhat by conducting a complete remodel as part of the fixing process. However, you’ll still be taking care of plumbing leaks and other household problems even with that approach.

- Tenant Challenges. Rental properties require tenants who provide the income stream. Finding those tenants is the first challenge. That’s followed by keeping the property occupied. And there are also a few tenants who are generally problematic in paying their rent on time or causing headaches with complaints or disruptions to other tenants.

These problems multiply for multi-family properties. For further information on rental properties, see our articles 12 Ways to Maximize Profit on Your Rental Properties and Top 10 Rental Markets.

Whether you are interested in fix and flip or fix and rent, both approaches require financing. To help you consider the options, we’ve provided a brief guide to private real estate loans. It includes details on what you need to do to secure a private loan. You can also review our article on the pros and cons of private real estate loans.

We hope this review has helped provide insight into fixing and flipping and fixing and renting properties. To find out about funding for your business through Sharestates, click here.