Key Takeaways:

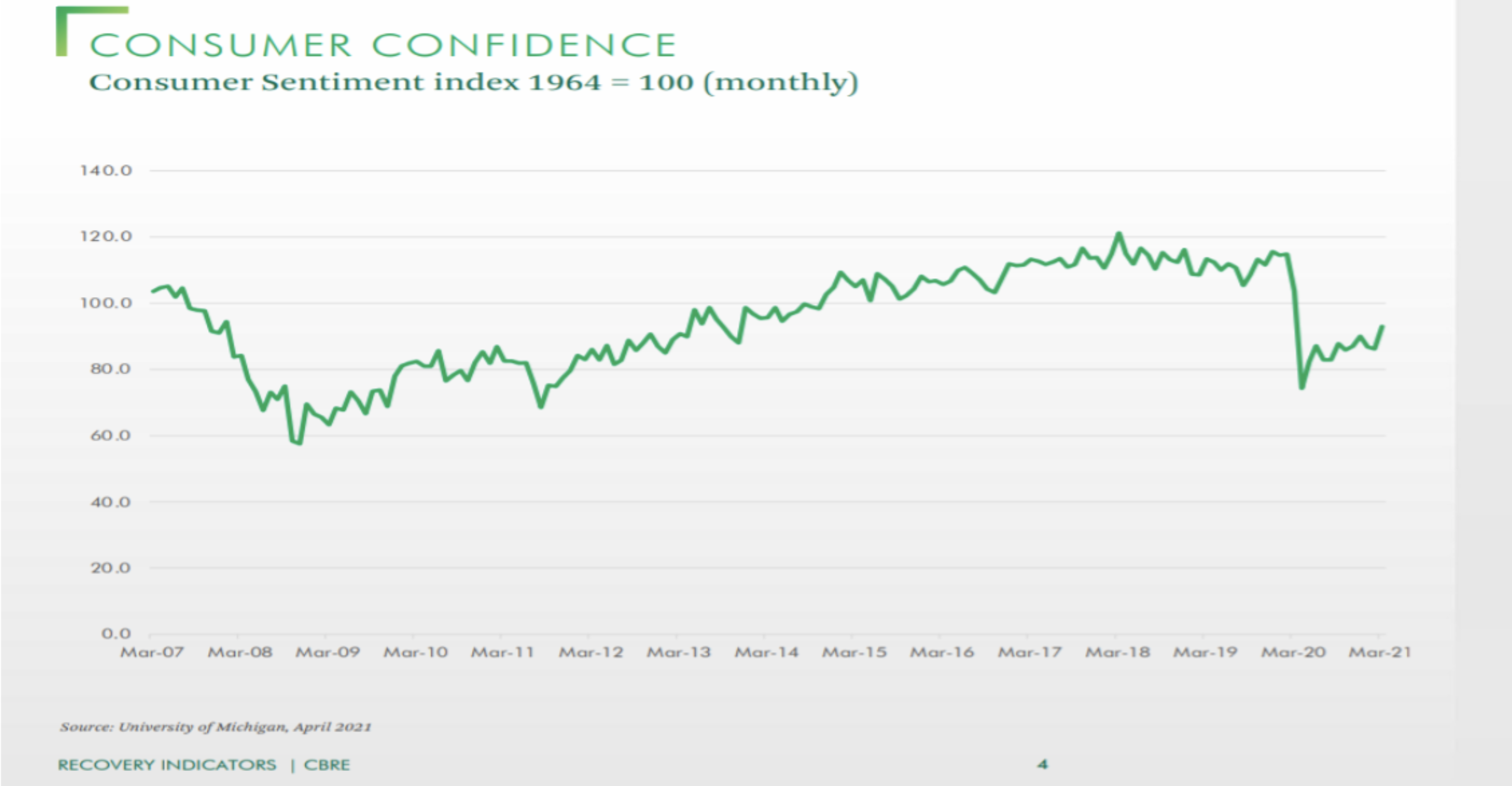

·Retail is showing signs of life again; consumer confidence is a driving force here.

·The uptick in key retail figures makes the asset class one of the most promising arbitrage plays in the months ahead.

·Mixed-use properties provide diversification of income for investors.

Retail was one of the hardest-hit real estate products amongst the other asset classes. Mandatory store closures forced many businesses that were already cash flow negative to shut down operations on a state and worldwide scale. As a result, e-commerces’ presence greatly increased as consumers were plugging in their credit card information online. Rightfully so, the convenience of being able to purchase items without moving too many muscles at home outweighed the traditional way of purchasing items in stores. While e-commerce is here to stay, expect in-store sales to increase over the second half of 2021 as the economy snaps back from the effects of the pandemic (per Cushman and Wakefield).

Comparatively speaking, asset classes such as MFR (Multifamily Residential) and SFR (Single Family Residential) outperformed their peers. These asset classes have seen immense price growth over the past year as consumers fled to suburban areas, leaving the retail market quite stale and seemingly unattractive. For this reason, CRE investors were hesitant to continue pursuing commercial space. According to CBRE’s U.S Capital Markets Figures for Q1 2021, total retail property investment in the United States decreased by approximately 42% YOY (year-over-year) between Q1 2020 and Q1 2021. However, at the same time we’ve seen investment activity in the sector decrease, we’ve also seen a significant uptick in some integral retail figures which makes the asset class one of the most promising arbitrage plays in the months ahead.

The Economic Overview

As the world starts to open back up after such a tumultuous period, retail will start to show encouraging signs of life again in the second half of 2021. Consumer confidence is a driving force here as people are finally walking and driving more again and feel much more comfortable than they did prior.

The American consumer is currently flush with cash and more optimistic than at any time since February 2020. During the second quarter of 2021, we saw the reopening of a substantial portion of the country as the CDC announced that those who are fully vaccinated no longer need to quarantine or practice social distancing. This led to a surge in spending on many of the activities, goods, and services that people have been restricted from in the past year.

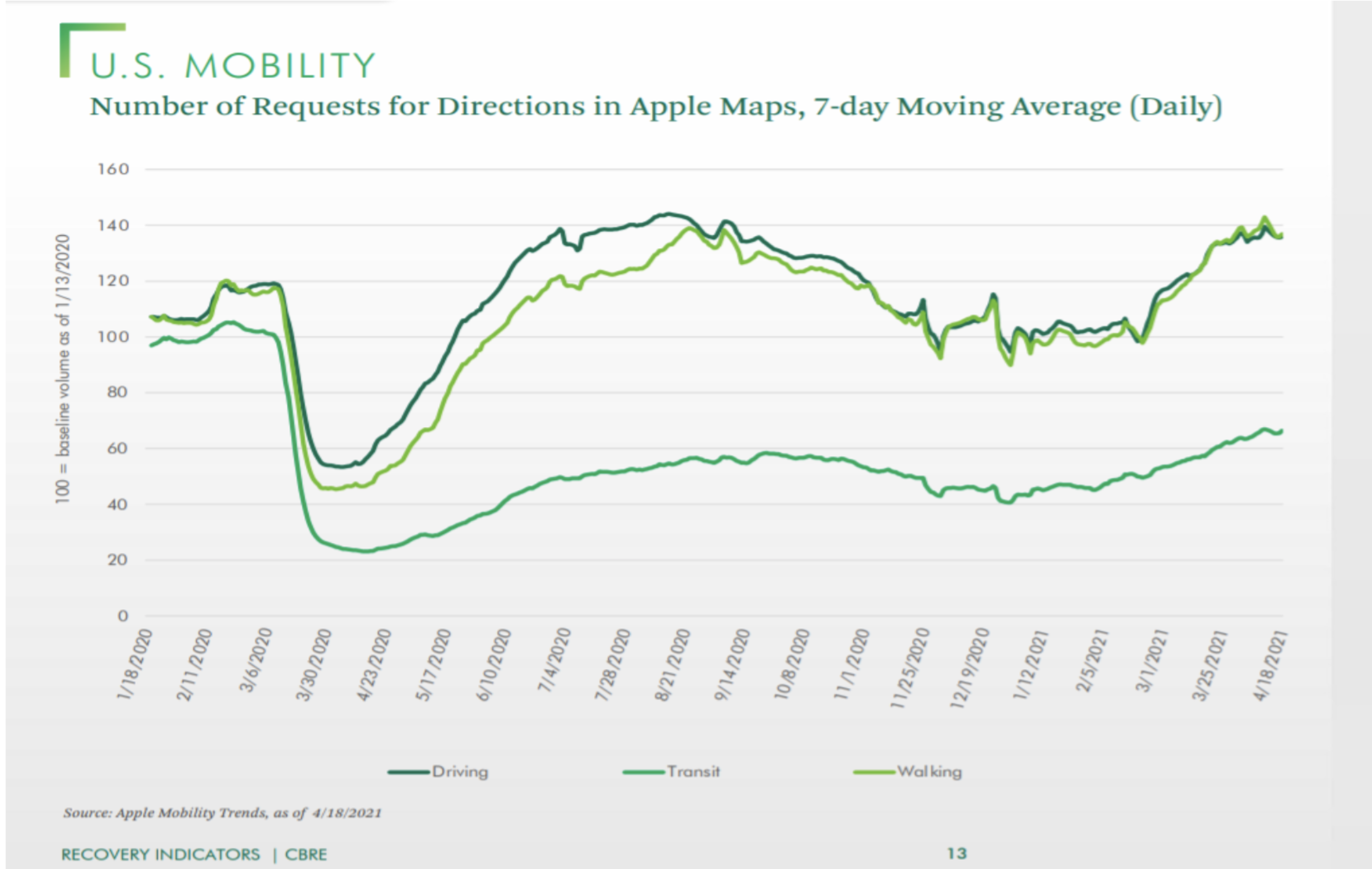

Total retail sales volume grew by 14% YOY between Q1 2020 and Q1 2021 with clothing, furniture, home improvement retailers, and sporting goods stores leading the way (according to CBRE). Another factor that contributes to retail’s comeback is the fact that consumers have become increasingly mobile. People are venturing off to explore new places and make memories there. They are no longer fearful of the virus because they are vaccinated. Walking, driving, and transit growth has increased to triple digits YOY (as seen below).

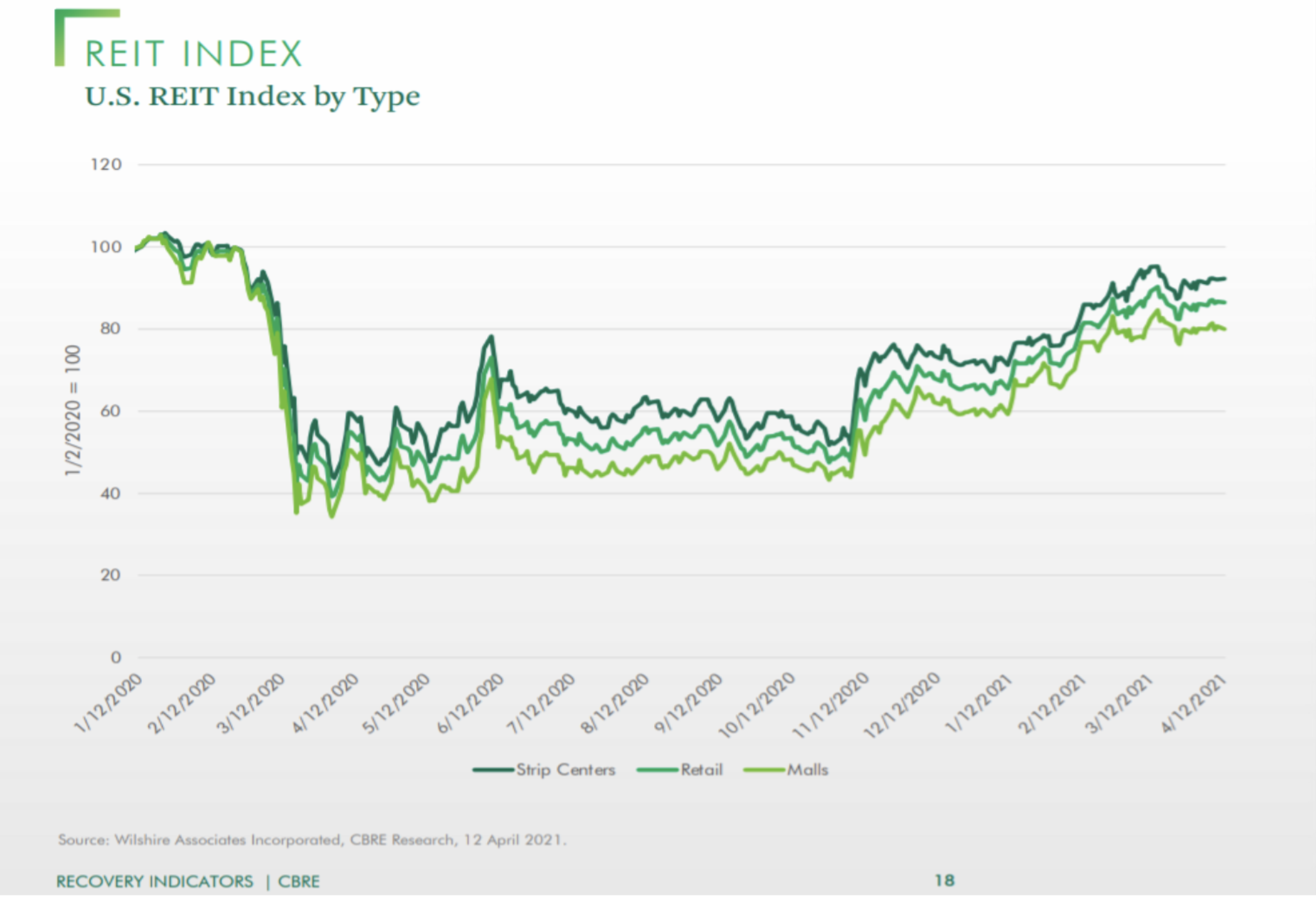

What does increased mobility mean for the CRE world? With the increase of people traveling to new places, this means that they are booking hotels and food accommodations. People are excited to visit their favorite places in their favorite cities. As a result, pent-up demand for retail services after a long hiatus will propel the CRE market in the near term (and already has). The REIT Index, as shown below, which consists of strip centers, malls, and grocery store segments, shows growth in the mid-60s.

According to the National Retail Federation’s (NRF) Chief Economist, Jack Kleinhenz, “given the strength of consumer spending, Kleinhenz noted he anticipates the fastest growth the U.S. has experienced since 1984…the reopening of the economy has accelerated much faster than most had believed possible, even a year ago.”

How Does the US Retail Market Compare to the Rest of The World?

It is also important to compare the United States CRE market with that of the rest of the world, focusing on Europe and the Asia-Pacific. Based on a market research report titled 2021 Outlook: Transitioning to the Next Cycle published by Hines View, which aims to explain the trend of CRE across the world using a plethora of variables, “…across the three major regions, declines in the average Leasing Environment Health Score (LHS) have been on par with the average of the last three recessions and much more in line with one another thus far than in the prior three downturns.”

The LHS is a composite indicator on a scale of 0-100 of three important fundamental real estate indicators: trailing annual demand growth, occupancy rates, and trailing annual rent growth. In essence, the higher the value, the better the rating. Warehouse facilities, for the most part, in Europe performed quite well as the focus on e-commerce became greater during the height of the pandemic.

When the (Adjusted Construction Score) ACS exceeded 70, rent growth over the following year has been quite strong. Historically, “average rent growth has been strong but cooling over the following five years when the ACS is high…when it is low, rent losses in the near term have slowly abated and given way to relatively strong growth in years four and five…this has important implications for underwriting and lease rollover analysis.” In Asia Pacific office markets, Tokyo’s ACS leads the region with an average of 60, and several submarkets in Mumbai and Sydney have positive and healthy ACS’s as well. In Europe, most of the European high-street retail markets have ACS’s in negative territory but that is primarily “due to weak fundamentals and only modest amounts of new supply.” Paris leads the region with a score of 20.

Based on the level of consumer excitement in NYC to finally be back, construction of the commercial spaces will resume. Shopping centers such as The Hudson Yards Mall will always be a hit. People from around the world come to NYC to visit the Vessel and all of the luxury stores across from it. Why? The unique structure is unlike anything the average person has seen. The Vessel is a crowd-pleaser given its modern and innovative design. By creating exquisite shopping center buildings, developers will be able to reinforce the notion that shopping centers aren’t dead.

Mixed-use properties are also expected to benefit. By combining various asset types into one building, developers, as well as landlords, can better serve not only the businesses but also the residents who occupy the space (per CREXI). Investing in mixed-use properties “provides diversification of income streams, helping the property sustain performance during difficult economic times, reducing investment risk.” A building containing a retail store or perhaps office space on the ground floor and apartments on the second will experience less business cyclicality. If the retail space isn’t doing too well, the apartment building facet will help compensate (vice versa).

Additionally, most mixed-use properties are located near attractive amenities which makes these properties desirable. Landlords will be able to charge higher rents, which in this case can be justifiable. According to Alyssa Adams of Bay Property Management Group, “… generally, commercial rates are between 6% and 12% of the purchase price. This boosts profits when combined with the 1% to 4% on residential units.” Thus, making mixed-use a very lucrative investment opportunity.