Since the Great Recession, there have been hundreds of new entrants into the alternative lending space. One of the fastest-growing areas of interest has been debt funds and real estate debt funds in particular. In fact, there were a total of 247 private real estate debt funds that closed between 2008 and January 2015. Those debt funds raised a total of $101.8 billion in institutional investor capital. To get a handle on these private lending real estate debt funds, it’s important to understand the capital stack. What makes up the capital stack, and who has the priority?

The 4 Major Tiers of the Real Estate Capital Stack

Generally speaking, there are two positions in any investment: Debt and equity.

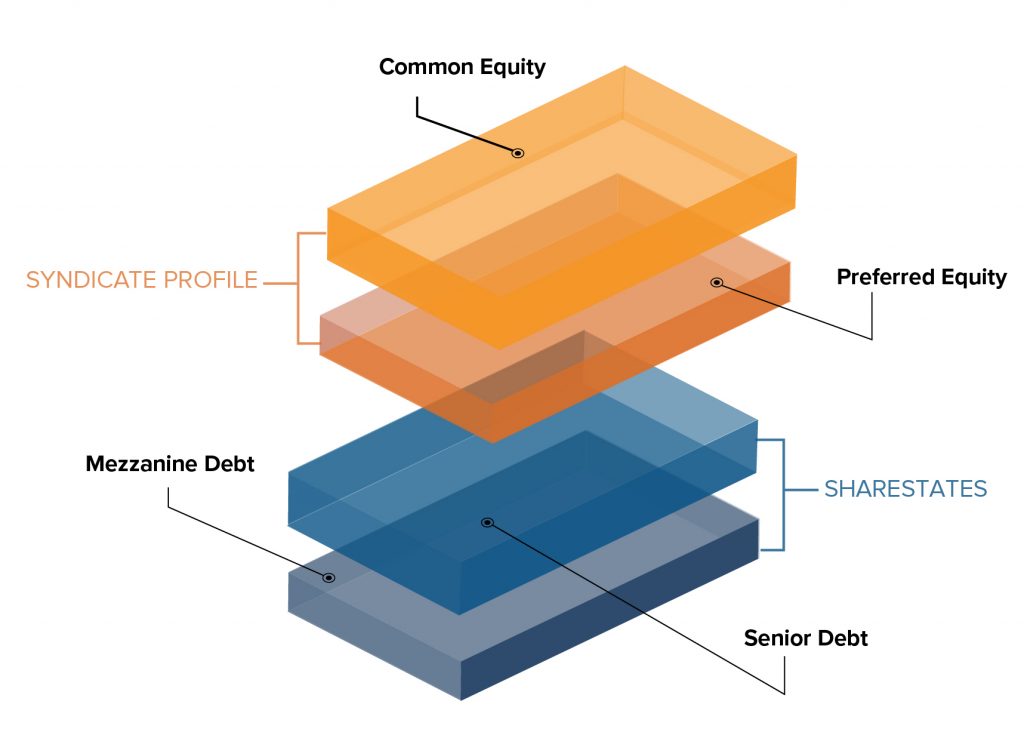

Within these two private investment categories, there are varying degrees of capital investment. The priority of investment return is determined by where the investor sits in the capital stack. In the simplest terms, debt investments have the highest priority while equity investments have the lowest. Unfortunately, few investments are that simple.

There are generally two types of debt. Senior debt is the first lender. This position on the capital stack entitles the investor to the first right of returns. In other words, when it comes to paying off the investment, if a deal is profitable enough to begin paying off investors, the senior lender is the first to be paid back.

What it boils down to is senior debt must be paid off before equity investors see any investment returns. The pay off is, equity investors generally see higher returns due to the higher risk factor.

Junior debt is any secondary loan taken out on a real estate deal. Often called “mezzanine debt,” these loans are riskier than senior loans. They are made with higher interest, and often, stricter terms. Because of the increased risk, the return on the loan is generally higher than the return for senior debt. If a deal goes south and doesn’t earn enough to pay off the first loan, the junior lender absorbs the loss.

After all, debt has been paid off on an investment, equity investors can receive returns. The two most common forms of equity investments are preferred equity and common equity. Preferred equity has the highest priority.

Similar to the difference between senior debt and mezzanine debt, common equity is riskier and therefore is subject to higher returns, but it has the least priority on the capital stack.

To further complicate the structure of the capital stack, preferred equity and mezzanine debt are often referred to as “bridge financing.” That’s because they are often issued in the middle of a project and are often used by developers and deal sponsors to raise capital in the midst of an ongoing project. That is, when further capital is needed to see a project to completion, developers look for bridge financing.

The capital stack looks like this:

The Emergence of Debt Funds Post-Financial Crisis

In recent years, changes to the debt financing landscape have made debt instruments in real estate more rewarding and attractive for investors. The advent of online lending, and the increase of alternative lenders after the passing of the JOBS Act of 2012, has made debt funding more attractive and lucrative for investors while providing some of the same benefits as equity investments. As a result, the alternative lending sector is much more competitive.

New technology has led to new and innovative approaches to lending. Real estate crowdfunding has exploded while securitizations have become more common for startups looking for operating capital. For the investor, these business models represent a steady income with a lower risk threshold.

New technology has led to new and innovative approaches to lending. Real estate crowdfunding has exploded while securitizations have become more common for startups looking for operating capital. For the investor, these business models represent a steady income with a lower risk threshold.

One emerging investment product is a debt fund. A debt fund is a pooled investment where investors combine their capital to take advantage of new opportunities for returns that were not available to them just a few years ago. Quite often, these funds invest in a diverse range of fixed-income opportunities from commercial real estate to long-term bonds. Generally, the fees are lower than those for traditional equity funds due to lower management costs.

Another unique aspect of a debt fund is the distributed risk factor. Because debt funds invest in a variety of securities with different risk profiles ranging from low risk to very high risk, investors spread their overall risk among the various investments in the fund. Operating like a mutual fund, investors also mitigate risk by sharing it with other investors.

How Real Estate Debt Funds Compete Using the Capital Stack

The key to attracting investors with any debt instrument is to create a product that appeals to their interests. Generally speaking, investors want low risk and high returns. Not all investments, however, can offer both simultaneously. Investments have traditionally worked this way: The higher the risk, the higher for potential returns; lower-risk investments generally offer lower returns.

The increase in real estate debt funds, on the other hand, has turned this traditional model on its head. Debt fund managers can use the capital stack to offer competitive investment opportunities for investors. Here’s how.

- Diversification – Lending is risky. Even senior debt, the highest priority on the capital stack, offers some risk. By diversifying the debt instruments within the real estate fund across multiple opportunities, the risk to the investor is mitigated as opportunities within each fund act as a hedge against each other.

- Focusing on the lowest risk categories – Even though diversification lowers the risk threshold, the rise in real estate lending in the last decade has offered debt fund managers plenty of opportunities to focus on senior debt, the lowest risk category on the capital stack. Fund managers can still diversify within that category and remain competitive. Every investment in the fund still has a higher priority than mezzanine debt and equity investments while offering respectable returns.

- Steady and frequent returns – Rather than tie up investor capital on long-term debt instruments, today’s debt fund managers can focus on short-term investments that provide higher returns even while diversifying portfolios. These opportunities generally yield income monthly until debt instruments are paid off.

- Rotating opportunities – Since debt fund managers focus on short-term debt opportunities, frequent maturation is a built-in component of real estate debt funds. That means fund managers must replace maturing instruments with new investment products on a regular basis. Therefore, investors often see a 100 percent turnover in investment opportunities within the fund every 12 to 24 months. These rotating opportunities serve to lower risk, diversify the fund portfolio, increase returns for investors, and offer a steady income.

Thanks to the rise of real estate debt funds, investors have better opportunities for returns than ever before. Many lenders focus on single investment types such as multifamily or commercial while others diversify their offerings across several types of investments. When performing due diligence, investors should ask how debt fund managers select the investments that are featured in their funds.

In today’s real estate lending landscape, platforms that offer debt funds for investors must offer investors high-return opportunities while mitigating risk. Using the capital stack to build the fund portfolio is the best way to achieve the best possible rewards.