The good macroeconomic news for real estate investors is that the Federal Reserve appears to be quiet.

That’s in contrast to 2019 when the Fed — after a series of nine target interest rate hikes in three years — reversed course. In dramatic fashion, the central bank dropped the Fed Funds rate a quarter-point per month for three straight months. While this might not be the license to print money that some real estate economists believe — we wrote about this here days before the start of that season of rate cuts — it’s still a positive signal for mortgage applicants and, thus, for the residential markets, single-family or multifamily, new or existing.

But while low-interest rates mean more potential buyers, it’s high capital rates that drive revenue. And it’s the spread between the two that drives what’s ultimately important to real estate investors: earnings.

Defining the cap rate terms

Cap rate, which measures the value of commercial real estate investments, is the ratio of the annual net operating income to the original cost of the property. The formula looks like this:

cap rate = annual net operating income / cost

Annual net operating income is defined here as the portion of the year’s lease income that isn’t going toward operating expenses, mortgage payments, taxes or any other costs. Cost usually refers to the purchase price.

Take for example an office building that generates $1 million in annual net operating income. If the owners sell it for $20 million, then its cap rate is 1/20, or 5%. This is important to investors in that neighborhood because it helps set values for nearby properties. If the building next door generates $2 million, then its owners could reasonably expect the same cap rate and price it at $40 million. Cap rates tend to go up as the local economy improves and down as it declines.

There are other factors, which tend to pop up in the appraisal process, but let’s keep things clean and simple for current purposes.

The target Fed Funds rate, meanwhile, is the rate at which the Federal Reserve Board of Governors and regional Fed presidents want America’s largest banks to charge each other for overnight loans. The Fed Funds rate is thus the lowest rate of interest charged commercially in the domestic market because the lenders and borrowers are the stuff of Goldman Sachs, JPMorgan Chase and the rest of the economic Illuminati.

The target Fed Funds rate, meanwhile, is the rate at which the Federal Reserve Board of Governors and regional Fed presidents want America’s largest banks to charge each other for overnight loans. The Fed Funds rate is thus the lowest rate of interest charged commercially in the domestic market because the lenders and borrowers are the stuff of Goldman Sachs, JPMorgan Chase and the rest of the economic Illuminati.

This rate is determined by a complex algorithm of dynamic … oh, baloney. It’s a matter of opinion. The dozen top policymakers at the Fed get together once a month for a couple of days of committee meetings. These are usually dry affairs because people who rise to the top of the Fed tend to be data-driven macroeconomics nerds who wrote doctoral dissertations in abstruse, statistics-heavy topics that will put you to sleep before you’re done reading the title page. Throw in a couple of career investment bankers whose family contacts have kept them gainfully employed, in civilian clothes and out of jail. Still, these are all political appointees, so there’s bound to be one or two bomb-throwers from either side of the aisle, but their input is largely ignored by the technocratic majority.

The goal is to pick a rate that will keep the economy chugging along at a sustainable rate. Too low a rate can lead to too much investment, which could lead in turn to too much production, too little labor available, too high an hourly wage and eventually to high inflation, which could cause the economy to crash. Too high a rate can lead to too little investment, too little production and eventually to too much unemployment, which could cause the economy to crash.

Again, this is a target rate. (Actually, since 2008 it has been a range of rates 25 basis points wide, with the upper limit being the successor benchmark to the pre-Recession target rate.) The Fed can’t just demand that banks charge each other a certain rate, but it has a number of tools to, shall we say, encourage compliance. Foremost among these is what is called open market operations, in which the Fed buys, sells or holds U.S. Treasury securities, including the bellwether 10-year Treasury note.

What’s important about the 10-year Treasury yield is that it is essentially without risk. It’s like savings bonds for grownups. No matter what happens, the T-note will keep making semiannual interest payments and thus keep its value. It is backed by the full faith and credit of the U.S. government and, if Uncle Sam stops making interest payments, then we’ll all have bigger problems to deal with than the direction of the cap rate spread.

Thought we’d forgotten about that, huh? The cap rate spread is the difference between the aggregate cap rate and the effective yield on the 10-year T-note. It’s a measure of the risk/reward premium for investing in commercial real estate instead of just buying into the safest bet available to mostly upper-middle-class individuals. As that spread widens, investors are more highly rewarded, indicating that there is a higher demand for investment in CRE because it is increasingly riskier of an enterprise. As that spread narrows, it means that there is less perceived risk. If you’re not interested in investing in a project, that’s okay with the developers because they can just call up your grandma and ask her for money.

You are here

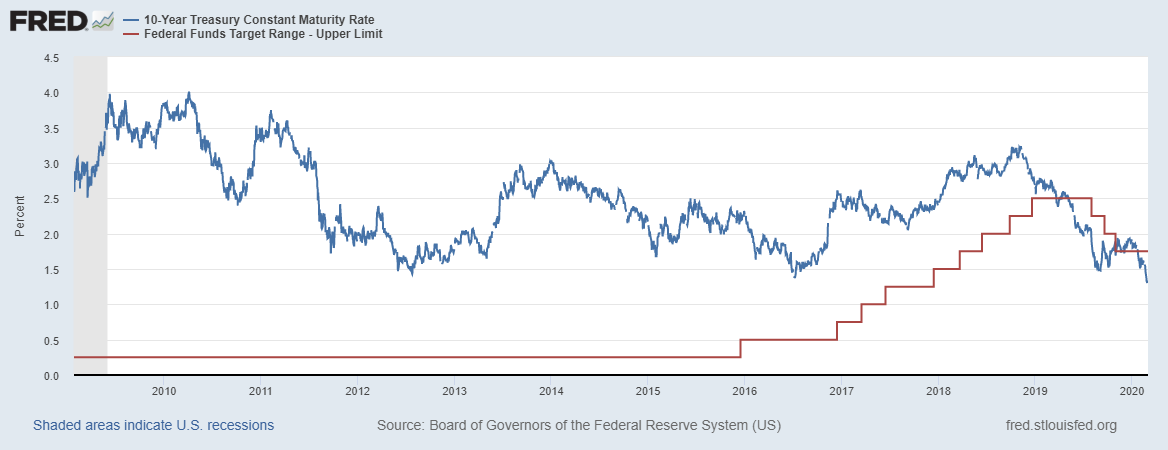

Let’s look at the relationship between the Fed Funds target rate — technically, the range’s upper limit — and the 10-year Treasury note’s constant maturity rate. This is courtesy of the Federal Reserve Economic Data repository, which carries the friendly acronym of FRED:

You’ll see that, historically, there’s a lot of daylight between the Fed Funds rate banks charge each other and the rate investors demand from the Treasury Department. As the economy improved during the ‘Teens, though, U.S. government debt began to look less dicey and Washington could get away with paying less interest. Meanwhile, the Fed ratcheted up its target rate to head off inflation. In 2019, partly in response to tweeting and name-calling from the White House, the Fed reversed course and began bringing down its target. At this rare moment, the 10-year Treasury yield and the Fed Funds rate are more or less the same.

You’ll see that, historically, there’s a lot of daylight between the Fed Funds rate banks charge each other and the rate investors demand from the Treasury Department. As the economy improved during the ‘Teens, though, U.S. government debt began to look less dicey and Washington could get away with paying less interest. Meanwhile, the Fed ratcheted up its target rate to head off inflation. In 2019, partly in response to tweeting and name-calling from the White House, the Fed reversed course and began bringing down its target. At this rare moment, the 10-year Treasury yield and the Fed Funds rate are more or less the same.

That’s neither a good nor a bad thing in itself. That was their relationship during the dotcom boom of the 1990s and during the best days just before the Great Recession. More typically, though, the Fed Funds Rate is the lower of the two, although the central bankers have been known to goose it for short terms as a shock treatment for inflation; it did this a lot in the 1970s and ‘80s.

But as of late February 2020, the 10-year rate is around 1.6%, having declined by 20 basis points since the start of the year, or a full percentage point over the past 12 months. While this is good information, we need to understand what’s been happening to cap rates in the meantime to determine what’s been happening with the spread.

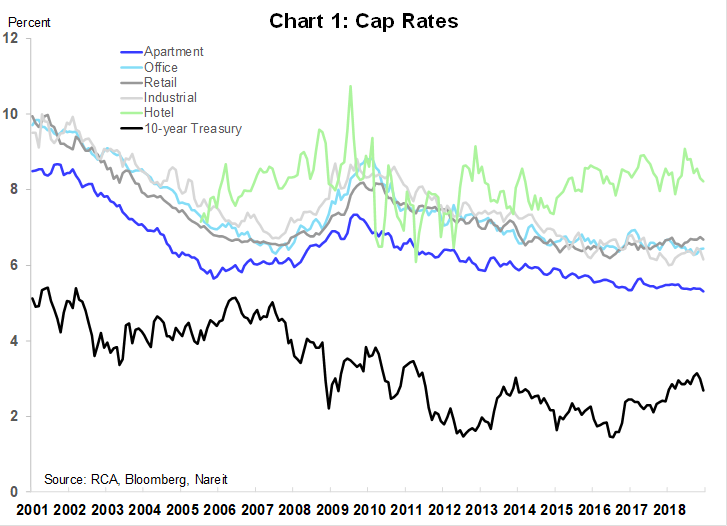

But notice our use of the plural: “rates,” not “rate”. Cap rates vary not only city by city, but also neighborhood by neighborhood. The best we can present is a national aggregate. Cap rates also vary according to project type, as this chart screen-captured from Nareit indicates:

Hotels generally command the highest risk premium, residences the least, with offices, retail and industrial space forming the layers of meat in the sandwich. They all tend to attract higher returns than the risk-free Treasury yield, as you’d expect. Going forward, we’ll focus on the multifamily market.

Hotels generally command the highest risk premium, residences the least, with offices, retail and industrial space forming the layers of meat in the sandwich. They all tend to attract higher returns than the risk-free Treasury yield, as you’d expect. Going forward, we’ll focus on the multifamily market.

According to Marcus & Millichap, “[t]he nationwide average apartment cap rate sits in the low-5 percent range, delivering a 300 to 350 basis-point premium above the 10-year note, among the widest spreads of the past decade.”

The road ahead

But whither shall cap rates go from here?

According to the industry association for real estate investment trusts, low Treasury yields should more than offset declining cap rates.

“[C]ommercial property price growth appears to be well-supported by rising [net operating income],” according to Nareit’s chief economist Calvin Schnure. “And the level of cap rates relative to Treasury yields translates into a good return to investors in commercial real estate.”

“Despite the decrease in cap rates, the spread between asking and closed cap rates for retail and office properties widened by 6 and 2 basis points respectively,” agrees Randy Blankstein of The Boulder Group. “Real estate investors believe we are in the late stages of the real estate cycle with fewer buying opportunities, especially those of high quality.”

It’s important to remember, though, that cap rates measure not just reward, but risk. It’s possible that the reason why they are declining — irrespective of their spread over Treasury yields — is that the mix of properties for sale is skewing toward the high end. The more bougie the property, the less economic risk. And this suggests that investors who want to see a better cap rate spread might be looking in the wrong neighborhoods. Workforce housing, as well as real estate in secondary and tertiary markets, might be presenting more perceived than real downside.

“With the vacancy rate scheduled to stay just above 3 percent this year, the Class C segment will garner attention from many investors,” according to Marcus & Millichap. “The strong job market has invigorated entry-level housing demand, delivering steady cash flows and comparably favorable yields in this asset class. The nationwide average cap rate for Class C properties rests in the mid-5 percent range, roughly 50 basis points above the all-class average.”