Key Takeaways

·The current 1031 exchange rule allows investors to sell a property and defer capital gains taxes by purchasing a “like-kind” property.

·The Biden administration seeks to increase the capital gains tax from 20% to 39.6% for those earning $1 million a year.

·Long term, we may see a significant drop in transaction volume as investors will likely be holding their properties for a much longer time.

A lot has been in the news lately regarding Biden’s tax change proposals and many of these changes target the real estate industry, specifically commercial assets and the investors who purchase and operate larger apartment buildings, retail shopping centers, and industrial buildings. While this is not law, yet, it is likely we will see a significant impact on the commercial real estate industry both in the short and long term. More importantly, it will be interesting to see how this proposal will affect asset pricing and transaction volume over the next few months. The 1031 exchange has been around for many decades and an entire ecosystem of companies has been built on 1031 exchange-related services.

The nature of real estate investing is for investors to continue buying properties with the end goal of either holding and waiting for the properties to appreciate or conducting renovations to flip the property for a quick profit. Before Biden’s proposal, capital gains were passed along to heirs tax-free at death. Per the WSJ, “Mr. Biden seeks to close the death loophole by taxing capital gains on inherited taxes.” Tax loopholes enable investors to save with less cash circulated back to the government. The Biden administration has proposed major tax changes in an attempt to pay for the stimulus packages that have been passed out in the past few months. Unfortunately for the real estate industry, these changes target active and passive investors as well as owners of commercial properties. Broadly speaking, tax laws tend to incentivize behavior which means that significant changes to the way your real estate investments are taxed can lead to property values, pricing, and how commercial real estate is bought and sold.

The first component and most directly targeted at the real estate industry is specifically the proposed elimination of the 1031 exchange for real estate capital gains greater than $500k. The 1031 exchange rule currently allows investors to sell a property and defer capital gains taxes by purchasing a replacement property of equal or greater value, incentivizing investors who created value in their projects to move on to a new deal and repeat the process without having to pay taxes on the value add. Approximately 12% of sales transactions were part of a “like-kind” exchange during 2016-2019 and 52% of properties sold in “like-kind” exchanges were residential properties, according to a 2020 survey from the National Association of Realtors. Also worth noting is that 84% of the properties that were exchanged for like-kind properties were “held by small investors in sole proprietorships (47%) in S-corporations (37%).” When asked about the impact on property values if Section 1031 were repealed, 94% of respondents reported that the repeal would ultimately lead to lower asset values. This would also create an unintended trickle-down effect to make the housing shortage we’re seeing in the United States even more severe.

The first component and most directly targeted at the real estate industry is specifically the proposed elimination of the 1031 exchange for real estate capital gains greater than $500k. The 1031 exchange rule currently allows investors to sell a property and defer capital gains taxes by purchasing a replacement property of equal or greater value, incentivizing investors who created value in their projects to move on to a new deal and repeat the process without having to pay taxes on the value add. Approximately 12% of sales transactions were part of a “like-kind” exchange during 2016-2019 and 52% of properties sold in “like-kind” exchanges were residential properties, according to a 2020 survey from the National Association of Realtors. Also worth noting is that 84% of the properties that were exchanged for like-kind properties were “held by small investors in sole proprietorships (47%) in S-corporations (37%).” When asked about the impact on property values if Section 1031 were repealed, 94% of respondents reported that the repeal would ultimately lead to lower asset values. This would also create an unintended trickle-down effect to make the housing shortage we’re seeing in the United States even more severe.

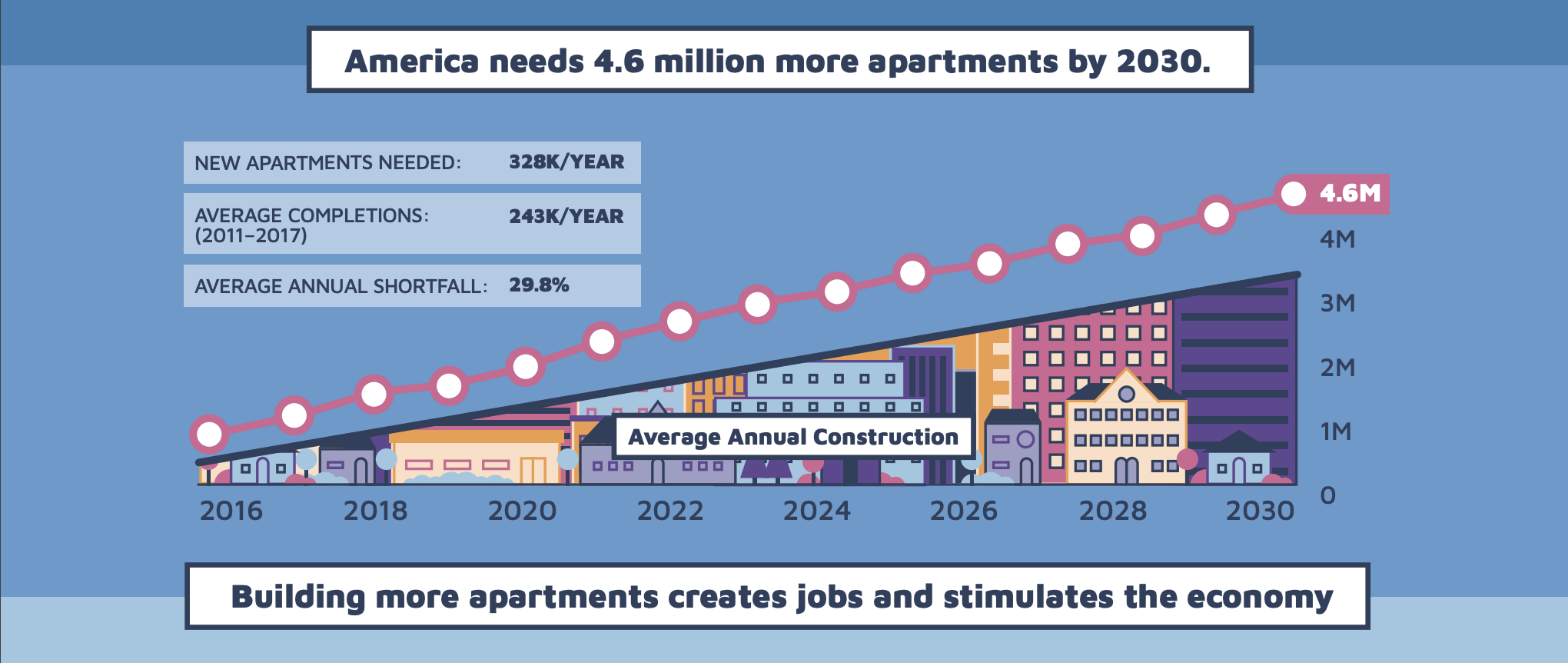

Residential real estate investors tend to go into acquisition seeking renovation opportunities, whether it be adding more units or simply applying cosmetic changes. If those would-be sellers can’t take advantage of a 1031 exchange, then they would be subject to a hefty capital gains tax upon sale. Thus, restricting the number of new properties entering the market in the future, per the National Multifamily Housing Council. The illustration below further bolsters the argument that developers need incentives to build homes. More importantly, as more homes are set to be built, this would enable the creation of a substantial number of jobs to facilitate the new projects.

The next proposed change that the Biden administration seeks to make is to increase the capital gains tax from 20% to 39.6% for those earning $1 million a year. It is no secret that property values have increased substantially since the onset of the pandemic. A shortage of homes paired with an intense consumer desire to purchase suburban homes creates an expensive market. Thus, if an average investor purchased a property for approximately $700k back in 2001, that property would be worth well over $1 million in today’s market. Even if this investor has a modest salary they have increased their net worth. The investor is now placed in a federal capital gains tax bracket of almost 40% (on what could be a majority portion of their net worth). Moreover, this is on top of the Net Investment Income Tax (NIIT) of 3.8% for married couples earning more than $250k per year.

If the capital gains tax is increased, then the taxation of carried interest may also change from being treated as a capital gain to being subject to ordinary income tax rates. Carried interest is simply the compensation general partners receive on real estate syndications and funds that allow them to receive additional profits on a deal in addition to the equity they invested after exceeding return hurdles set by their capital partners. If for example, capital gains tax rates double for high-income earners, carried interest on mid-sized to larger deals would likely be subject to the 39.6% income tax. Investment firms also rely on promoted interest checks to help fund their operation and to reinvest in their business.

Let’s say that this proposal is passed. What would happen next? First, there would be a sell-off in commercial real estate properties in the short term to squeeze out the benefits of the current 1031 exchange plan. Since more properties will be listed on the market, asset prices will go down and cap rates will increase, potentially causing a buyer’s market. Long term, we may see a significant drop in transaction volume as investors hold their properties for a longer time. There is no guarantee that this proposal will pass. If it is passed, then there will most likely be a middle ground. In the meantime, it’s something real estate investors should monitor and be prepared to fine-tune their strategy before new laws are codified.