Key Takeaways:

• The Multifamily sector managed to weather the storm better than most sectors.

• Vacancy rates for affordable multifamily housing will likely be low.

• With more people renting multifamily properties in suburbs, the higher cost of city living becomes in question.

How the Pandemic Impacted Major Urban Markets

Major cities, whether it be New York or Los Angeles, faced a similar dilemma during the onset of the Covid-19 pandemic—over saturation in a confined area. What was once an energetic and animated city, New York City fell silent as more and more people started to exit into the suburbs in hopes of getting more living space. At one point, NYC perhaps even lost its luster at the height of the pandemic. It is undeniable that the virus has transformed almost every facet of our lives, ranging from spending habits all the way to living situations.

Comparatively speaking, the Multifamily sector performed better than most asset classes. The Commercial space was terribly affected almost immediately as businesses were forced to shut down and offices to vacate. According to a report published by Deloitte, “new [CRE] investments slowed down due to increased uncertainty and valuation concerns.” Sentiment treaded lower and lower with no bottom in sight. However, the CRE market is also making a comeback, though at a slower pace than the multifamily sector.

What Does the Future Look Like For Multifamily?

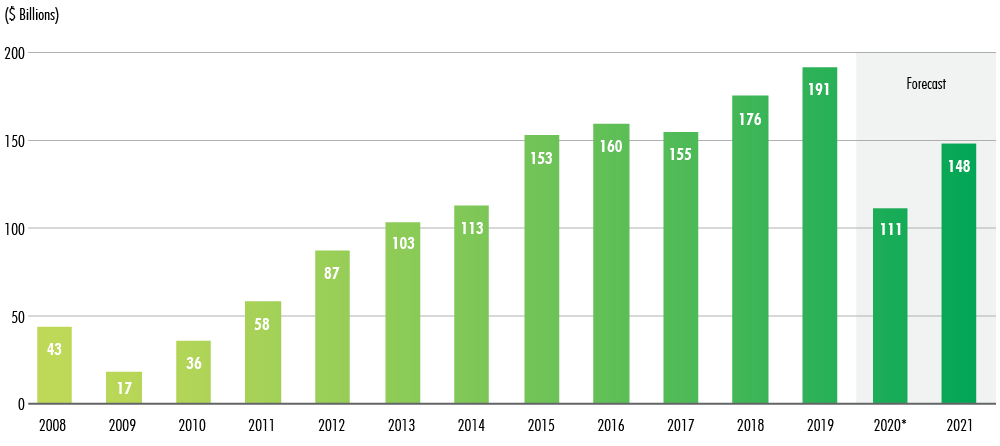

Multifamily investment sharply rebounded between Q4 of 2020 and Q1 of 2021. CBRE predicts growth of 33% paired with “favorable mortgage rates” that will provide further incentive for increased investment. The bar graph below shows helps to illustrate this trend:

Source: CBRE Research, Real Capital Analytics (historical), Q4 2020.

With more people fleeing the major cities and finding homes in the suburbs, vacancy rates in the suburban multifamily market have declined. Areas like Long Island and the suburbs of New Jersey seemed to be the biggest winners here. Government aid certainly helped people expand their supply of cash along with a decrease in consumer spending (at least in the beginning portion of the pandemic). Consumers are able to spend more and for a longer duration.

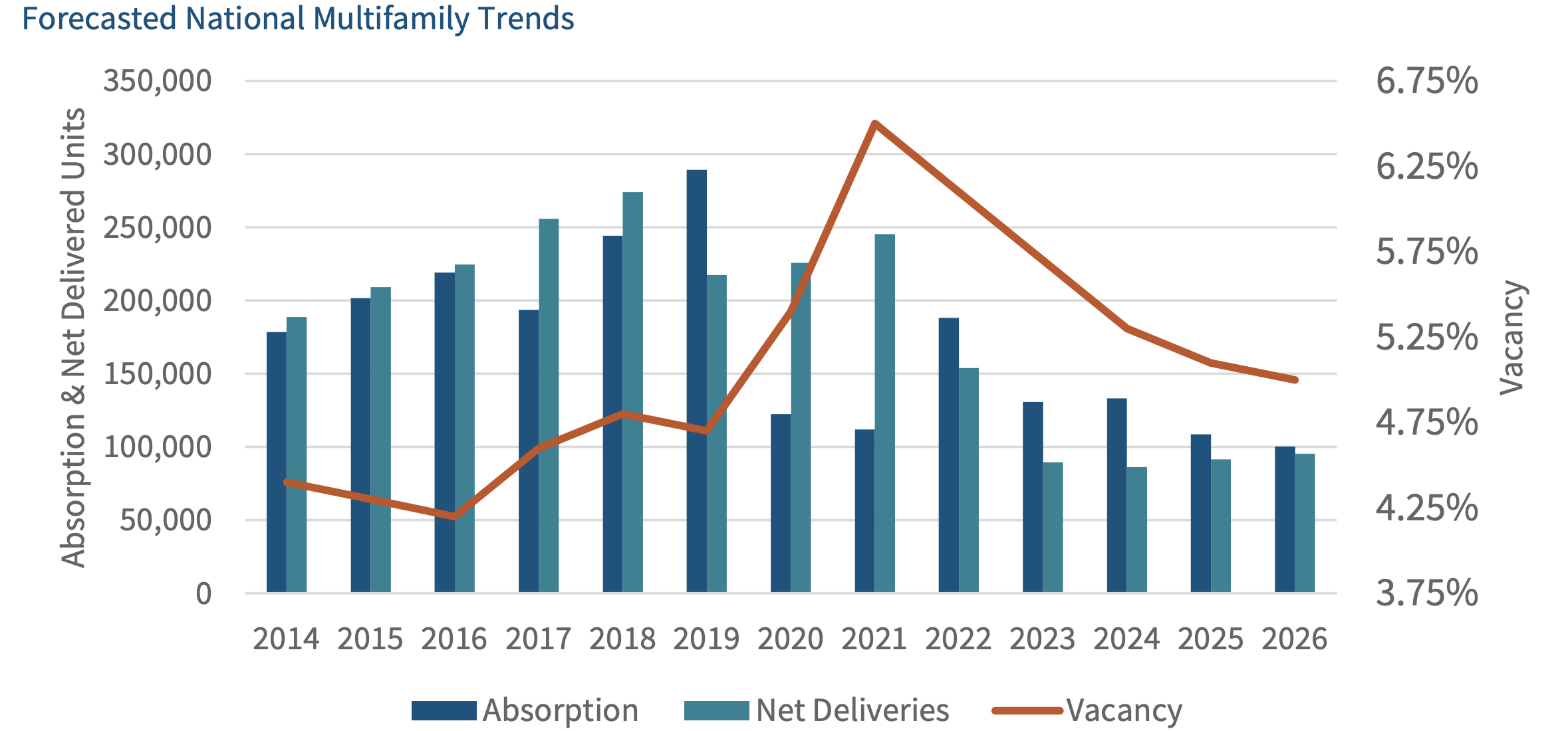

According to an outlook commentary published by Fannie Mae, “The national multifamily vacancy rate is expected to peak in 2021, at around 6.5 percent… and then begin to trend downward starting in 2022.”

Consumers and investors have become much more comfortable with the Multifamily segment. Suburban multifamily properties continue to generate rental income consistently with little borrower delinquencies. The multifamily market is past the “bottoming out” stage as more consumers develop confidence in the nation’s recovery.

Rents in NYC will rise eventually but the fact of the matter is that the suburbs seem way too attractive not to rent or purchase. NYC will certainly come back but the overall recovery of the city may still be in question. The de Blasio administration (per The Real Deal) plans to bring back 80,000 employees which include caseworkers, computer specialists, and clerical staff into the office which is a good sign for the city’s recovery and overall public sentiment.

To view Sharestates’ open real estate investments create an account here.