Debt investment refers to an investor lending money to a firm or project sponsor with the expectation that the borrower will pay back the investment with interest.

Methods of debt investment

Debt can be either secured or unsecured. If borrowers can’t pay back secured debt, they forfeit an underlying asset, called collateral. In real estate, that collateral is typically the property. Unsecured debt doesn’t have collateral and is backed only by the borrower’s creditworthiness.

Bonds and loans comprise most debt issued in the U.S. The difference, then, is whether or not it is a security. A bond is issued through an underwriter which offers them in specific denominations, usually $1,000 or $5,000. Like any other instrument that trades on an exchange, bonds are securities. Unsecuritized debt is like a bank loan or credit card payment — it can be for whatever amount the lender and borrower agree to. While investors routinely trade bonds on exchanges, they also trade loans, although these transactions are usually between private parties.

Real estate property secures mortgages. Almost all bonds have some underlying collateral, which could be real estate or something else. The word for an unsecured bond is debenture.

Distinction from equity investment

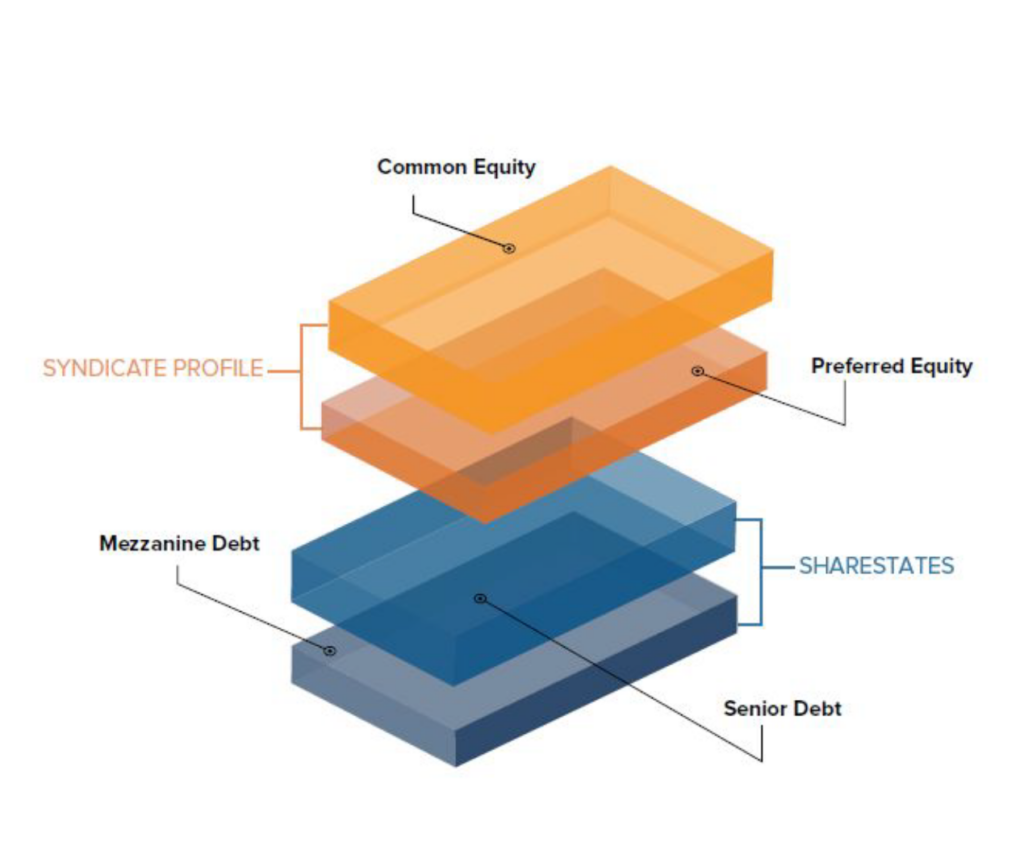

The capital stack illustrates the different types of investment ranked by riskiness. The riskiest, common equity, is on top and the least risky, secured debt, is on the bottom.

Financial professionals often call debt investments “fixed-income” because, no matter what, borrowers must pay back a specific amount at specific intervals. If they can’t keep up with their obligations to lenders, the entire project or firm goes out of business. The courts then sell the assets to ensure that the debt holders receive as much of their investment back as possible. Only after completely satisfying these claims can management pay anything out to equity holders.

Debt, then, is less risky than equity. But it also tends to offer lower returns. If the business achieves phenomenal success, management would declare ever-increasing dividends and the share price would soar. Debt holders would still receive the same agreed-to fixed-income returns.